Introduction

The MedTech industry is buzzing with growth and innovation, and the numbers are here to substantiate the narrative. From a whopping 536 billion euros in global revenue in 2021 to an almost 37 percent CAGR in the healthcare AI market for the next eight years, the statistics are staggering. But numbers only tell part of the story. As we dive deeper into the data, we explore what this means for startups, particularly from an Intellectual Property (IP) strategy angle.

In this article on the worldwide Medical Technology Industry, we will look at:

- Worldwide revenue trends in the medical device industry from 2007 to 2021 and beyond

- The distribution of global MedTech revenue by category in 2021

- The current and future market size of in vitro diagnostics (IVD)

- The rise of the medical robotics market from 2021 to 2030

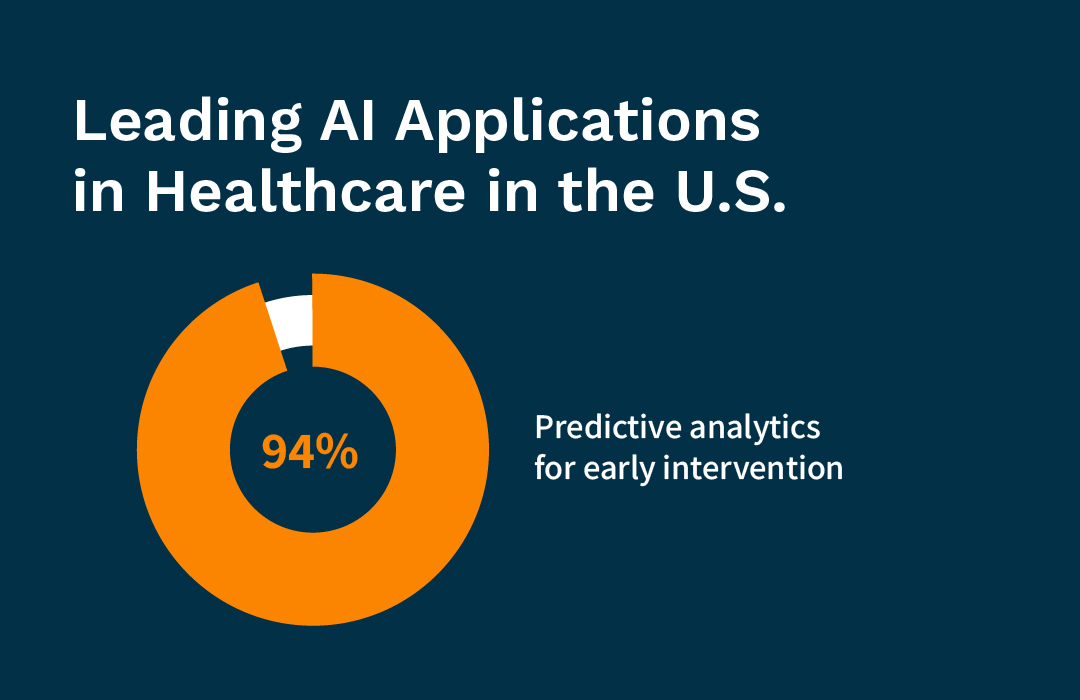

- The growing impact of Artificial Intelligence (AI) in the healthcare sector, including its applications and adoption rates in different regions to 2023

Here are some of the highlight & take away statistics:

What is MedTech?

Before we dive into the numbers, it’s imperative to establish a comprehensive understanding of what exactly “MedTech,” or medical technology, encompasses. The term may appear deceptively simple, but its scope is broad and continually evolving. At its core, MedTech is an interdisciplinary field that merges the principles of engineering and medical sciences.

Medical Devices: These range from simple tools such as thermometers, blood pressure monitors, and syringes, to more complex apparatus like MRI machines, cardiac pacemakers, and life-support systems. In recent years, there has been a surge in robotic-assisted surgery systems, telehealth platforms, and wearable health tech, like smartwatches capable of monitoring a range of physiological parameters.

In Vitro Diagnostics (IVD): These are the technologies used to analyze biological samples outside the body. They are critical for a range of healthcare decisions, from determining blood type for transfusions to confirming a cancer diagnosis via biopsy. With advancements in molecular diagnostics and genomics, IVD technologies now also include high-throughput sequencers and CRISPR technology, which have revolutionized the way we approach diagnosis and treatment planning.

Each component within the MedTech umbrella serves different but interconnected roles, collectively creating a healthcare ecosystem designed to be more efficient, accurate, and accessible. While the definition of MedTech may be static in textbooks, its real-world applications are dynamic, responding to technological innovations and emerging healthcare needs.

Why is MedTech Important?

Understanding MedTech is not just an academic exercise; it has far-reaching implications for healthcare systems globally.

So, why is MedTech so crucial?

Enhanced Diagnostic Accuracy One of the foremost benefits is the increase in diagnostic accuracy. Advanced imaging technologies, for instance, allow for earlier and more precise detection of conditions like cancer, leading to improved outcomes and reduced treatment costs.

Remote Healthcare Telemedicine platforms and wearable tech are changing the way healthcare is delivered, making it more accessible, especially in remote or underserved regions. These advancements have been particularly invaluable during the pandemic, where in-person consultations were often not feasible.

Customized Treatments Personalized medicine, backed by sophisticated diagnostic tools, allows doctors to tailor treatments to individual patients. This customization significantly enhances treatment efficacy and minimizes side effects.

Surgical Precision Robotic surgical systems, guided by human hands but calculated in their movements, minimize invasiveness and improve outcomes. Their rise is transforming traditional surgery, resulting in faster recovery times and reduced complications.

Resource Optimization MedTech also aids in the efficient allocation of healthcare resources. Data analytics tools can forecast patient influx, allowing healthcare centers to adequately prepare in terms of staffing and supplies.

Accelerating Drug Development Advancements in data analytics and machine learning are expediting drug discovery and development. They offer the ability to predict how different drugs will interact with targets in the body, slashing both the time and cost required for clinical trials.

Patient Empowerment Finally, wearable devices and health monitoring apps are putting health management into the hands of consumers, encouraging proactive healthcare and reducing the burden on formal healthcare systems.

MedTech is not just an industry but a global paradigm shift in healthcare delivery and management. Its impact is far-reaching, shaping healthcare policies, industry norms, and ultimately, the well-being of individuals around the world.

Throughout this article, we shall be looking into the MedTech market, but also paying close attention to how MedTech Intellectual Property (IP) plays its part, too.

Data on the Global Medical Technology Market

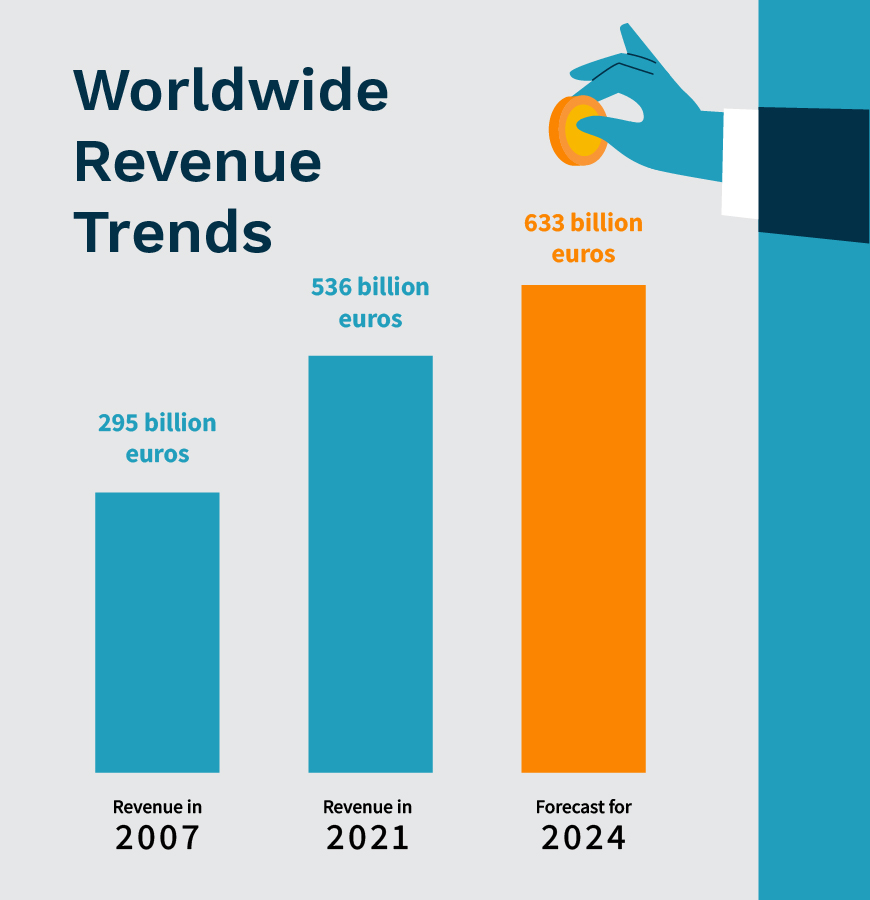

Section 1: The Global Revenue Landscape of MedTech

Worldwide revenue of medical technology industry from 2007 to 2021, with a forecast for 2024 (in billion euros)

Source: Statista

Key Data Points:

- 2007 revenue: 295 billion euros

- 2021 revenue: 536 billion euros

- 2024 forecast: 633 billion euros

In-Depth Analysis: The Financial Clout and Intellectual Implications of MedTech's Meteoric Rise

The financial landscape of the MedTech industry is nothing short of transformative, with numbers that are as compelling as they are indicative of its growing influence on the global stage. But to truly appreciate the nuances, let’s delve into the intricacies of how MedTech has skyrocketed from a 295 billion-euro industry in 2007 to an astounding 536 billion euros by 2021. Even more captivating is the projection that this sector will further swell to an anticipated 633 billion euros by 2024. But what do these staggering numbers signify, particularly from an Intellectual Property (IP) standpoint?

MedTech Revenue Fuels R&D

The interplay between revenue and Research & Development (R&D) is a classic example of a virtuous cycle. As revenues increase, companies can allocate more funds into R&D efforts. With the high cost of developing medical technologies—which includes lengthy clinical trials, validation studies, and regulatory approvals—adequate funding is vital. This revenue influx thereby becomes the bedrock for future innovations, enabling companies to explore cutting-edge technologies that could further disrupt the industry. The implications for IP are profound. More R&D typically results in more patents filed, meaning that each technological breakthrough is not just a win for the inventing company but a fortified moat that protects them from competitors.

MedTech’s Untapped Intellectual Capital

In a world driven by information, MedTech firms are not just manufacturing devices or diagnostic solutions; they are creating knowledge. Each product often comes embedded with algorithms, software, and data analytics capabilities. This generates a plethora of IP assets, including patents for hardware, copyrights for software, and trade secrets for proprietary algorithms. In essence, the high revenues don’t just represent sales figures but signify the accumulation of significant intellectual capital. This adds layers of valuation to the industry beyond the immediately apparent financial metrics.

MedTech’s Global Appeal: Not Just a Western Phenomenon

The astronomical growth in revenues and the corresponding IP accumulation are not isolated to any particular geography. With healthcare demands universal and growing, especially in aging societies and burgeoning middle-class populations in emerging markets, the MedTech industry has a truly global footprint. This multiplies the IP complexities as companies must navigate different regulatory landscapes and IP laws, often having to localize technologies to meet specific regional needs. As a result, companies not only require an international IP strategy but also a nuanced approach to product development and market entry.

Competition vs. Collaboration in MedTech

The immense revenues and corresponding technological advancements have led to a fascinating dynamic between competition and collaboration. On one hand, companies are vying for market share, often guarded by a formidable arsenal of patents. On the other hand, the sheer complexity and interdisciplinary nature of MedTech solutions are driving unprecedented collaborations—be it between startups and established players or between MedTech firms and pharmaceutical giants. These collaborations come with their own intellectual property challenges and opportunities, including shared patents, cross-licensing agreements, and co-developed technologies.

The IP Strategy Imperative

As we look at these revenue trends and consider their implications, it becomes unequivocally clear that an astute IP Strategy is not just an accessory but a necessity for MedTech companies. With revenues and stakes this high, every patent filed, every trade secret guarded, and every copyright registered becomes part of a complex puzzle that shapes the industry’s future. Therefore, companies that fail to effectively manage and leverage their IP assets are essentially leaving money on the table—a misstep that no player can afford in this high-stakes, rapidly evolving landscape.

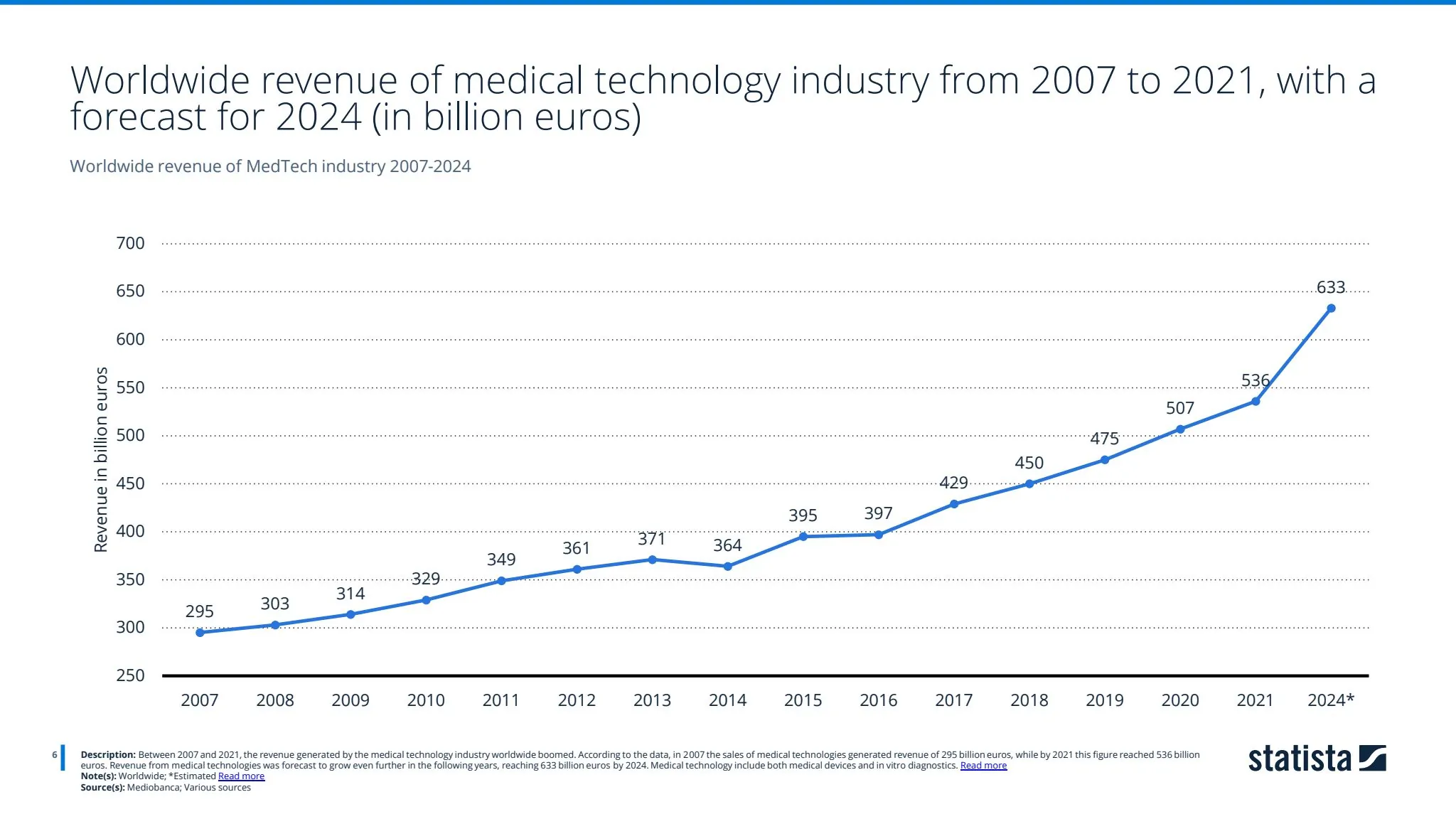

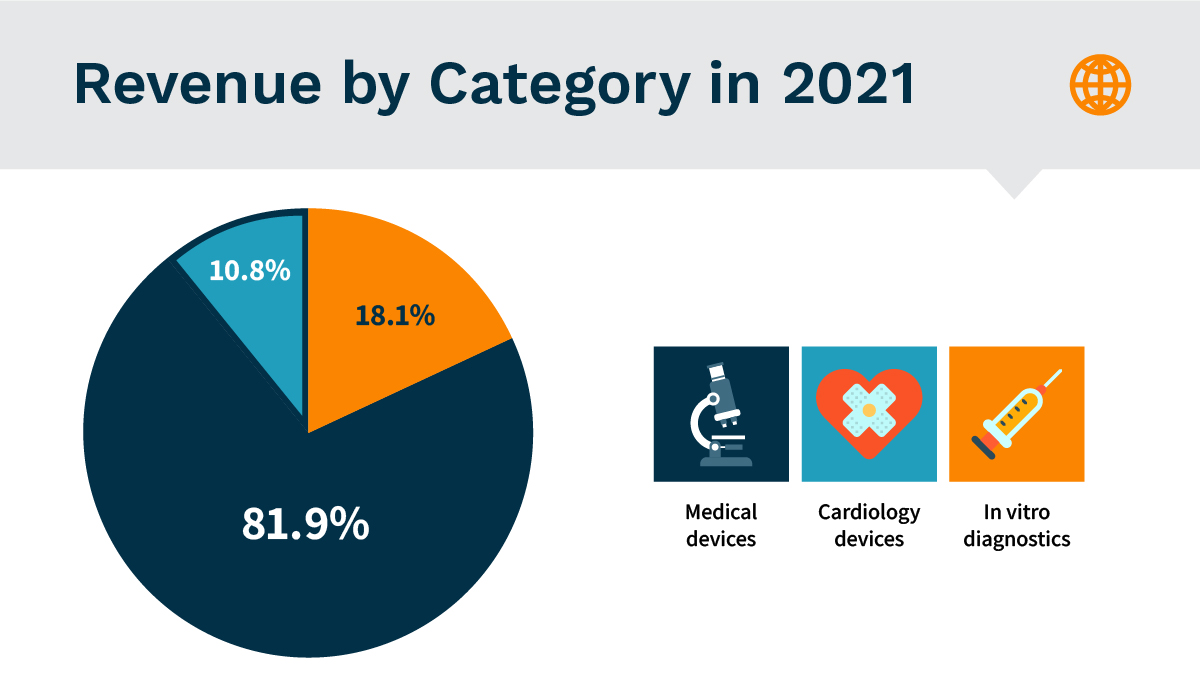

Section 2: The Category Breakdown of MedTech Revenue in 2021

Distribution of the global revenue of medical technology industry in 2021, by category

Source: Statista

Key Data Points:

- In vitro diagnostics: 18.1% of revenue

- Medical devices: 81.9% of revenue

- Among devices, cardiology is the leading category, representing 10.8%

Analysis:

A Deep Dive into MedTech Revenue Distribution: Uncovering the Sectors Steering MedTech’s Profits and Intellectual Horizons

The landscape of MedTech is both sprawling and intricate. With a total revenue of 536 billion euros generated in 2021 alone, this expansive sector offers more than meets the eye upon first glance. Delving deeper into the disbursement of this revenue is akin to opening a treasure trove of insights, particularly for those in the IP Strategy space.

The Main Sub-sectors: In Vitro Diagnostics and Medical Devices

While the term “MedTech” broadly encapsulates an array of technologies, the real story lies in its segmentation. In 2021, in vitro diagnostics (IVD) commanded a sizable 18.1 percent of the overall MedTech revenue. Although it may seem like a smaller slice of the pie, its financial clout should not be underestimated. As IVD becomes more sophisticated with advancements in molecular diagnostics and genomic sequencing, it’s likely to become a hotbed for patents and intellectual property (IP).

Meanwhile, the rest of the revenue, a staggering 81.9 percent, is cornered largely by medical devices. This imbalance in revenue distribution suggests that medical devices are the current bellwethers of MedTech innovation, but it also implies a greater diversity in the types of IP assets generated, from patents for mechanical designs to copyrights for accompanying software systems.

Spotlight on Cardiology: A Sector Full of Opportunity

Within this landscape, it’s vital to hone in on sectors that are making the most noise—quite literally, in the case of cardiology. Cardiology devices alone represented 10.8 percent of MedTech’s overall revenue in 2021. The significant financial pull of this specialized sector signals more than just robust sales; it indicates a hotbed of innovation where patenting activity is likely frenetic. Devices ranging from stents to pacemakers to more advanced cardiovascular imaging technology represent rich territories for intellectual property. IP managers would be wise to keep an eye on cardiological innovations for portfolio diversification and to safeguard their competitive edge.

Want to understand how The Intellectual Property Works can help ensure you & your IP Managers are fully equipped with the knowledge, tools and resources needed to stay ahead in the MedTech industry? Book in a free, no obligations call to discuss your situation today

IP Strategy: The Quest for Portfolio Diversification

One crucial implication for those involved with IP in a medical technology setting to glean from this revenue breakdown is the potential for portfolio diversification. A well-balanced IP portfolio often mimics market trends, and in the case of MedTech, that means considering a multi-category approach. For instance, having patents in the burgeoning field of cardiology can be a strategic move, not only due to its significant market share but also because of its propensity for technological advancements that can lead to new, defensible patents.

Geographical Intellectual Property Considerations

Another layer to consider is the geographical aspect. Since MedTech is a global industry, IP professionals must tailor strategies to cater to different markets with unique health challenges and technological appetites. What might be a revolutionary cardiac device in one part of the world could be irrelevant in another. Consequently, international patents and trade secrets become increasingly valuable as companies strive to capitalize on diverse global opportunities.

Positioning Intellectual Property as the Compass

Understanding the nuances of revenue distribution in MedTech is akin to reading a map in a treasure hunt. It provides the compass directions for IP managers to navigate a complex and ever-evolving terrain. By aligning IP portfolios with the areas commanding the most significant market share—be it in vitro diagnostics or medical devices, or within specialized fields like cardiology—companies can better position themselves for sustained growth, competitive advantage, and ultimately, greater innovation that pushes the boundaries of what MedTech can achieve.

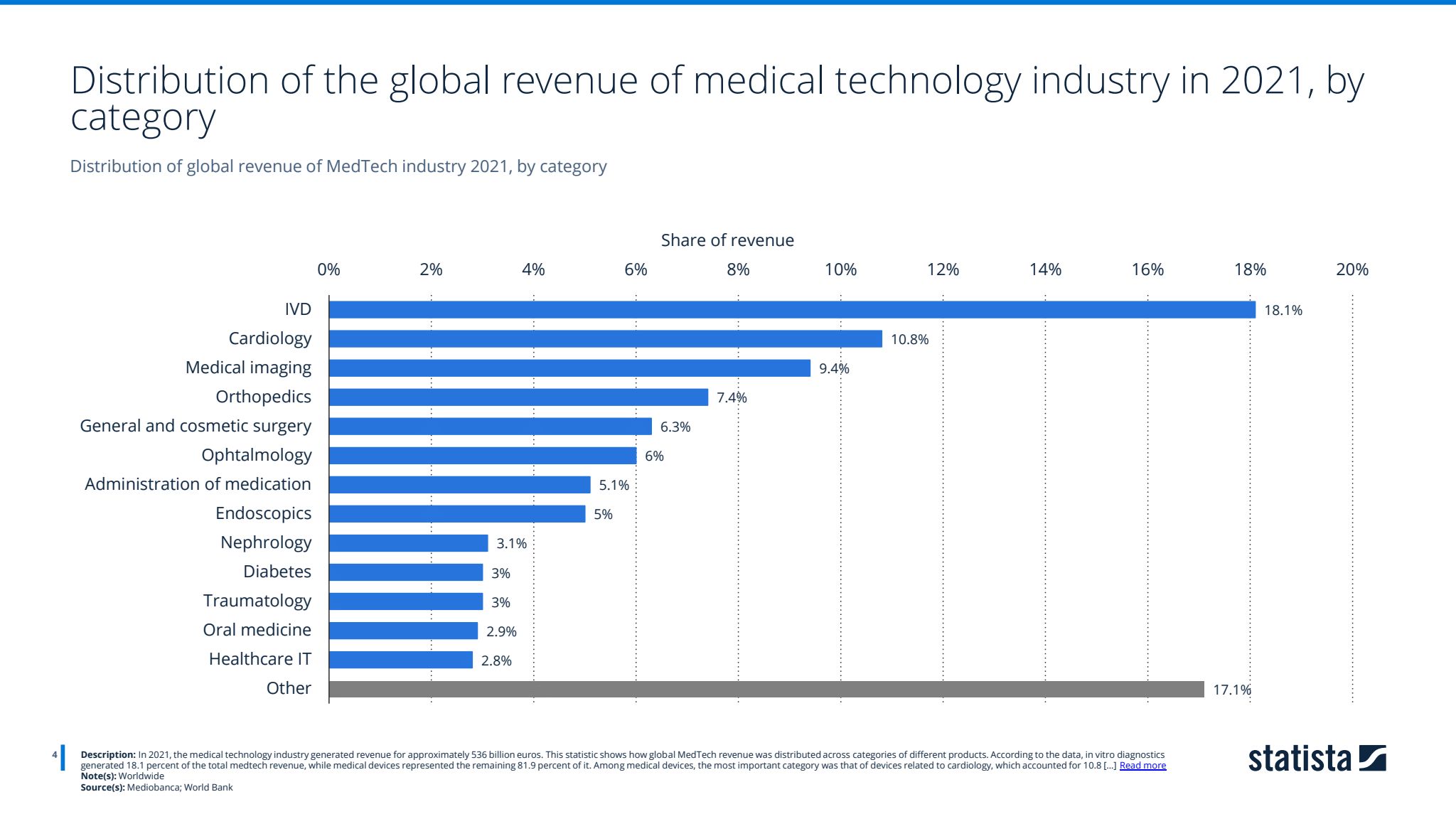

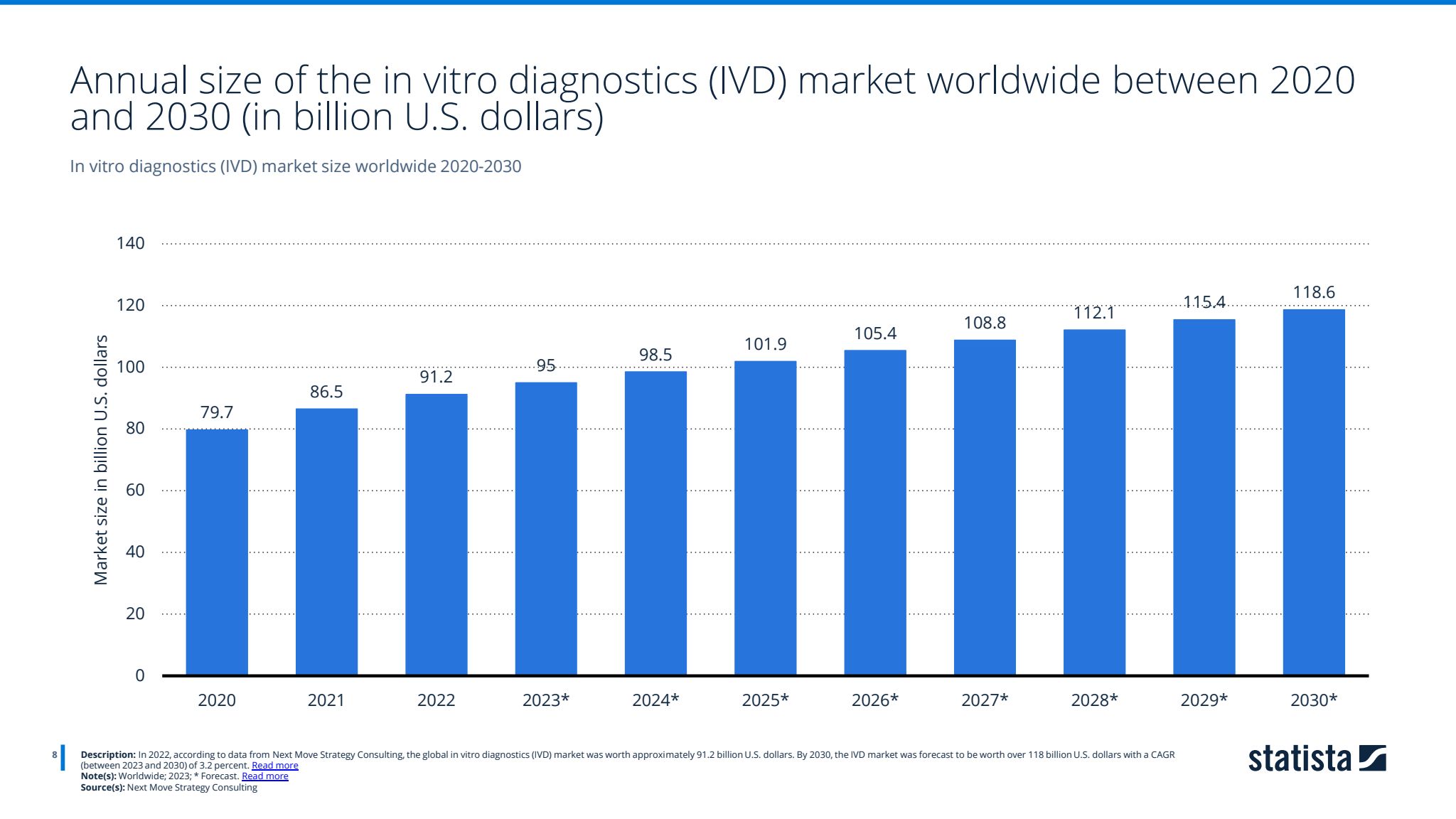

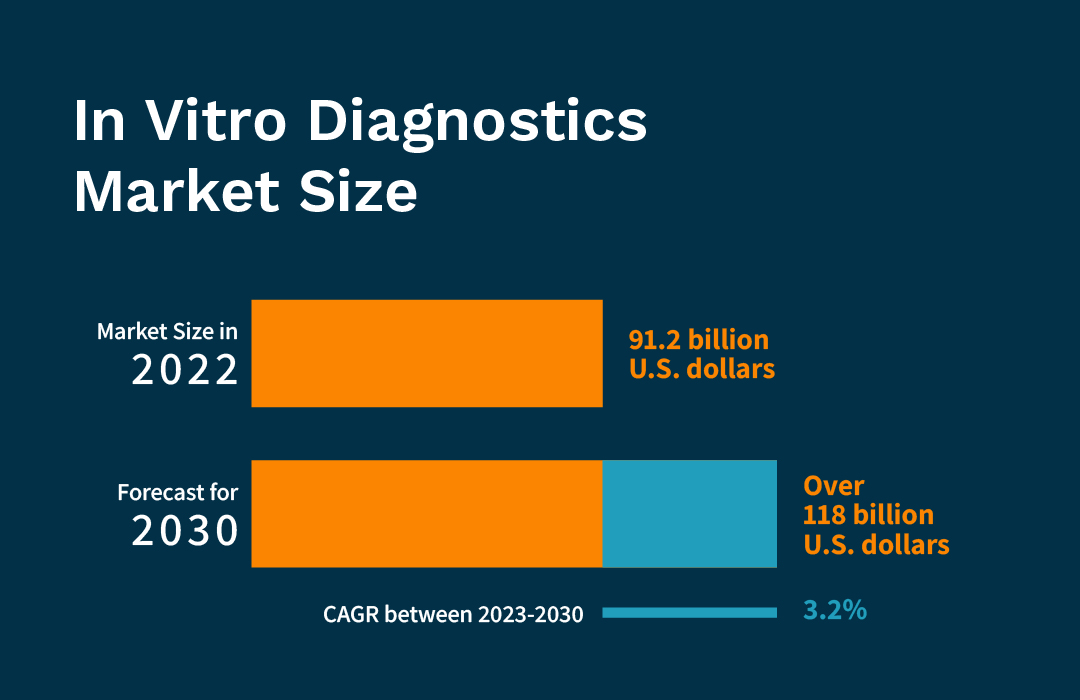

Section 3: The In Vitro Diagnostics (IVD) Market Size and Growth

Annual size of the in vitro diagnostics (IVD) market worldwide between 2020 and 2030 (in billion U.S. dollars)

Source: Statista

Key Data Points:

- 2022 market size: 91.2 billion U.S. dollars

- 2030 forecast: Over 118 billion U.S. dollars

- CAGR (2023-2030): 3.2%

Unpacking the IVD Market: An Ongoing Ascendancy with Long-Term Implications for IP Strategy & IP Management

The global in vitro diagnostics (IVD) market is more than just a fraction of the larger MedTech ecosystem—it’s an empire in its own right. With a valuation of approximately 91.2 billion U.S. dollars in 2022, and a forecast to cross the 118 billion U.S. dollar mark by 2030, this sub-sector is not just growing; it’s thriving. The data paints a picture of a robust and resilient market, but what are the deeper implications for IP Strategy & IP Management.

CAGR Shows A Steady Growth Rate

First, it’s important to digest the Compound Annual Growth Rate (CAGR) of 3.2 percent expected between 2023 and 2030. While 3.2 percent may not seem like a staggering figure at first glance, in a market as large as IVD, even marginal growth rates can equate to significant financial gains. It also implies a market less susceptible to extreme volatility, offering a more predictable landscape for long-term investment, including in IP assets.

A Landscape Ripe for Innovation: Fostering IP Assets

The IVD market is an amalgamation of numerous technologies—from reagents and test kits to fully automated platforms, each with its own potential for patenting and other forms of intellectual property. The incremental growth pattern indicates that newer, potentially patentable technologies will find a market prepared for adoption. For those managing IP within their organisation, the steady growth offers an opportunity to accumulate a diversified portfolio of patents that can be monetized over the long term.

Diagnostic Precision: Tailoring IP Strategies to Target Needs

The IVD market also comprises a range of applications, from infectious disease diagnostics to genetic testing. Recognizing the applications that are driving growth enables IP managers & IP professionals to focus on areas of greatest opportunity. Patents can be sought for new methods of diagnostics, the use of AI in IVD, or novel biomarkers that could revolutionize how we detect diseases. In a steadily growing market, these innovations are more likely to see commercial success and generate licensing revenue.

Global Market, Local Nuances: IP Considerations Across Borders

Just like the broader MedTech arena, the IVD market is global. However, the demands and trends in IVD can vary significantly from region to region. IP managers should be adept at understanding these regional nuances. For instance, while genetic testing may be on the rise in some western markets, infectious diseases might dominate the IVD landscape in other parts of the world. Tailoring IP strategy to these localized needs is crucial for maximum market penetration and ROI.

Want to understand how The Intellectual Property Works can help ensure you & your IP Managers are fully equipped with the knowledge, tools and resources needed to stay ahead in the MedTech industry? Book in a free, no obligations call to discuss your situation today

Using Your Intellectual Property as a Vehicle for Sustained Growth

One of the standout takeaways from the projected growth of the IVD market is that this is a long game. A forecast reaching to 2030 provides ample time for the maturation of IP assets. It’s an invitation for IP professionals & IP managers to think long-term, to invest in research and development that may have a payoff period extending over multiple years.

Intellectual Property (IP) as the Crux for Innovation and Revenue

The solid and steady ascendance of the IVD market should be seen as fertile ground for IP professionals. Whether it’s identifying niches within diagnostics for targeted patenting, understanding the geographic implications of a global market, or formulating long-term strategies for intellectual property development and monetization, the growing IVD sector offers a stable yet dynamic arena for the evolution of next-gen diagnostics and, by extension, next-gen intellectual property portfolios.

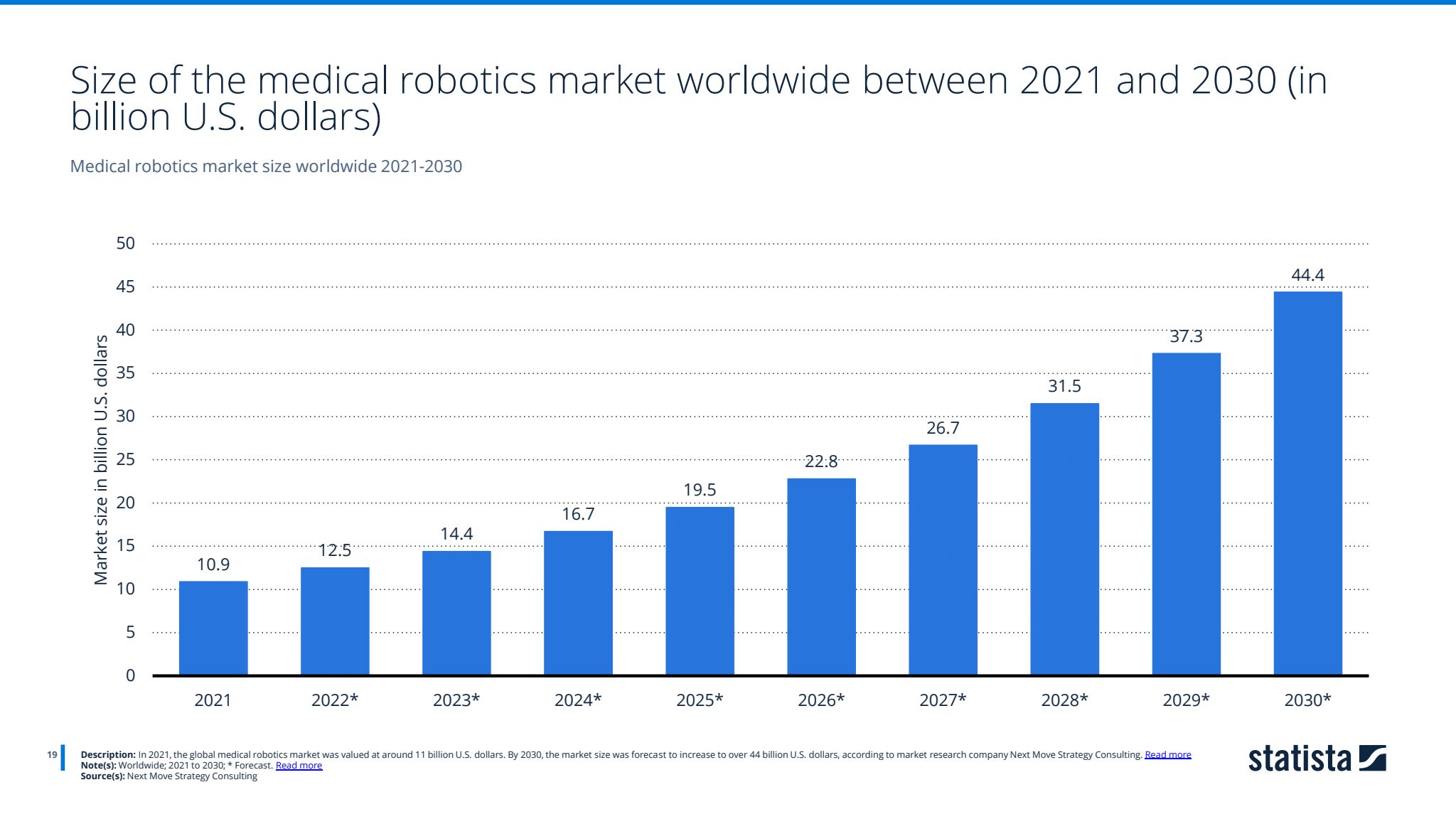

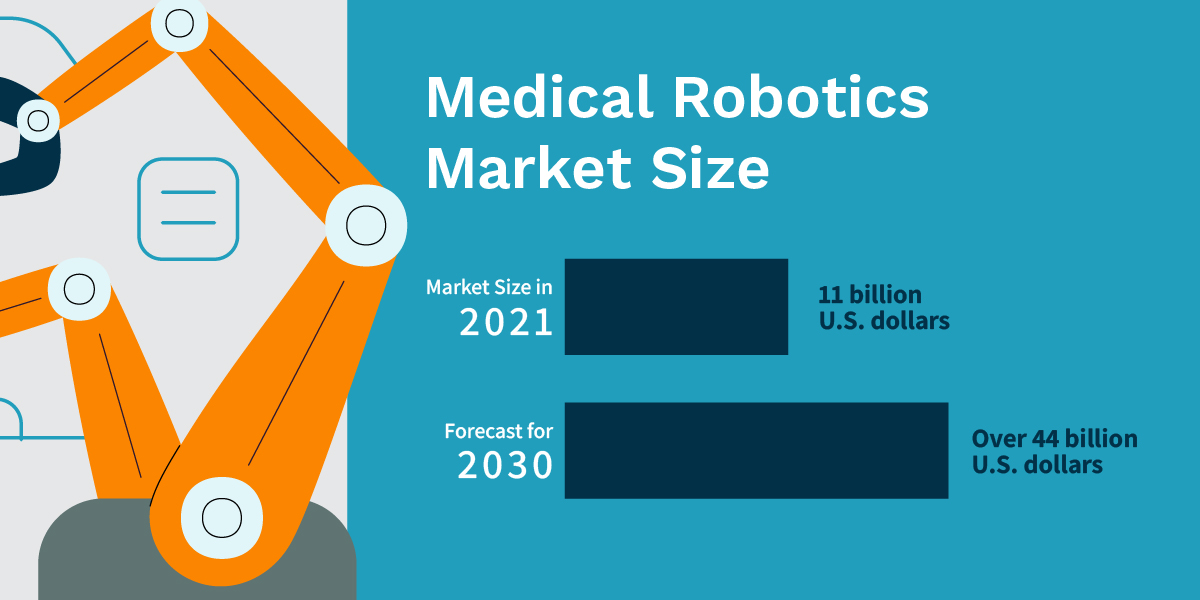

Section 4: The Medical Robotics Market Outlook

Size of the medical robotics market worldwide between 2021 and 2030 (in billion U.S. dollars)

Source: Statista

Key Data Points:

- 2021 market size: 11 billion U.S. dollars

- 2030 forecast: Over 44 billion U.S. dollars

Decoding the Surge of the Medical Robotics Market: Navigating Intellectual Property Complexity in a High-Stakes Arena

Medical robotics is rapidly becoming a cornerstone of modern healthcare. It’s not just a rising star; it’s a skyrocketing one. With a market valuation of 11 billion U.S. dollars in 2021 and a staggering projected value of over 44 billion U.S. dollars by 2030, the medical robotics market is unquestionably a sector to watch. But what does this expansion mean for intellectual property IP Management?

Medical Robotics See Exponential Growth

The first aspect to note is the magnitude of the market growth: a quadrupling of value within just nine years. This isn’t incremental growth; it’s exponential. In economic terms, this represents a booming market, but from an IP viewpoint, it signals a sprint of innovation where being first—or best-protected—can confer significant advantages.

Where Hardware Meets Software: Potential IP Complexities

Medical robotics is an interdisciplinary field, requiring expertise in mechanical engineering, computer science, and biomedical engineering, among others. This means that the IP landscape is equally complex. IP managers & IP professionals are looking at a multifaceted web that includes hardware patents, software patents, and the ever-tricky terrain of how these two integrate. The complexity extends beyond simple device patents to cover algorithms that control the robots, data analytics software, user interface designs, and more.

Want to understand how The Intellectual Property Works can help ensure you & your IP Managers are fully equipped with the knowledge, tools and resources needed to stay ahead in the MedTech industry? Book in a free, no obligations call to discuss your situation today

Intellectual Property as a Competitive Advantage

Given the rapid growth and technical complexity of the field, first-mover advantage is critical. Companies that are first to market not only gain the lion’s share of consumer attention but also have the first opportunity to secure IP rights on new technologies. But being first isn’t the end of the story. Maintaining a competitive edge in such a fast-evolving field requires ongoing innovation—and ongoing IP Strategy to protect that innovation.

Regulatory Hurdles Add An Additional Layer of Complexity

A notable feature of the medical robotics market is its heavy regulation. Medical devices must undergo rigorous testing for safety, effectiveness, and compliance with numerous international and local standards. This adds an extra layer of complexity to the IP strategy. Any new invention must not only be patentable but must also stand up to regulatory scrutiny—a two-pronged challenge that requires a well-coordinated approach.

Building an Agile IP Strategy

As the medical robotics market grows, so too will its IP challenges. Companies must be agile, and prepared to pivot their IP strategies in response to new technological advancements and market trends. IP portfolios should be continually assessed and updated, ensuring that they not only protect current assets but are also structured in a way that enables future growth.

A New Frontier for IP: The Interplay of Data and Robotics

As the market becomes more advanced, they will likely incorporate more data analytics and even Artificial Intelligence. This opens new avenues for IP, especially in the integration of robotics with AI algorithms, which itself is a nascent field of IP law. Being prepared for these evolutions can set a company up for long-term success.

Intellectual Property at the Intersection of Innovation and Opportunity

The meteoric rise of the medical robotics market represents not just a wealth of business opportunities but also a labyrinth of intellectual property challenges and considerations. This is an arena where the stakes are high, but so too are the rewards. Navigating this landscape successfully will require deep expertise in both the technologies involved and the IP mechanisms that can protect them, making the role of IP strategists more critical than ever.

If you would like to discuss how an effectively structured & managed IP Strategy can secure your business’ present and future interests, book in a free no obligations call to talk to an expert IP Strategist and former IP Attorney today

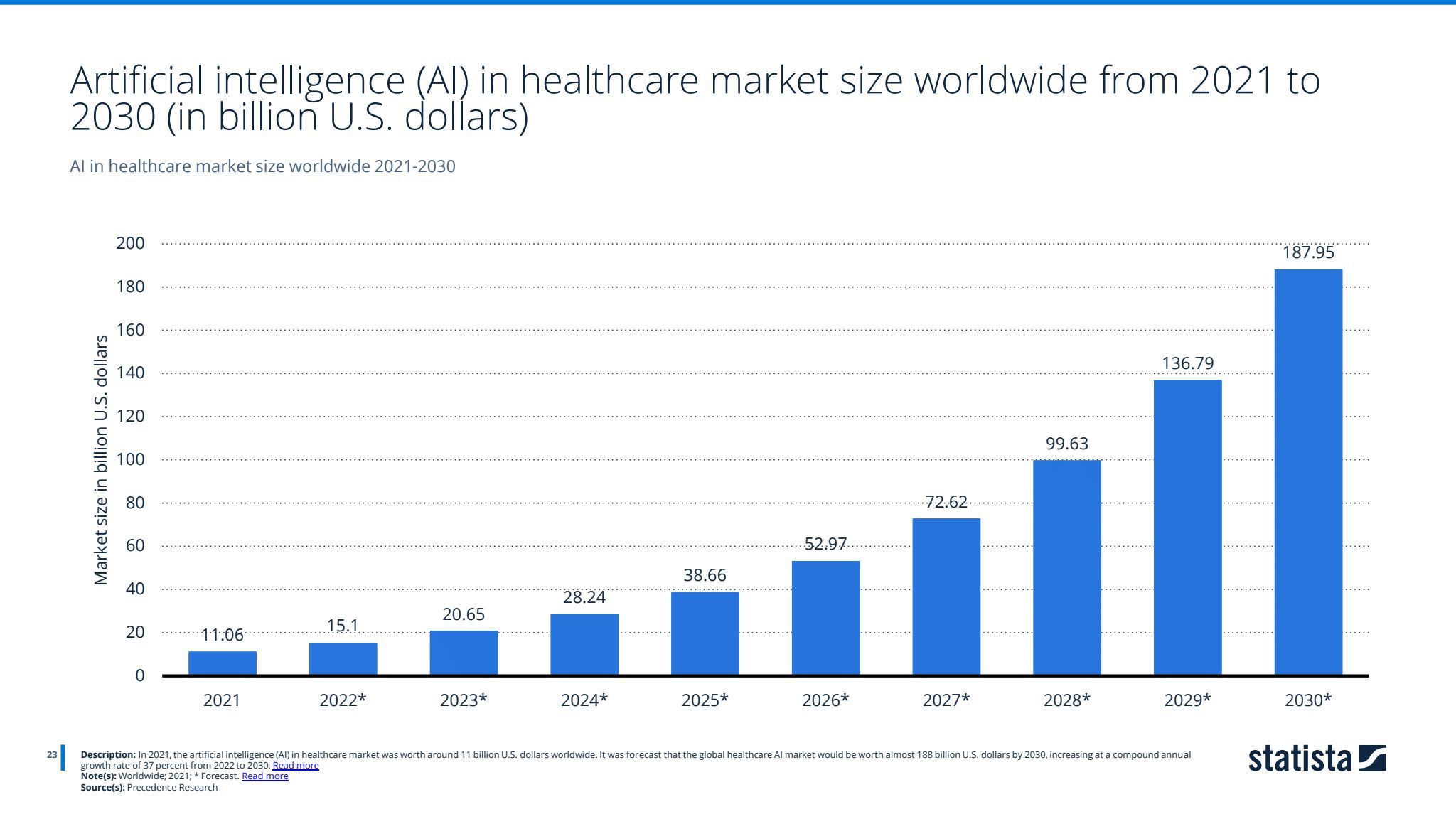

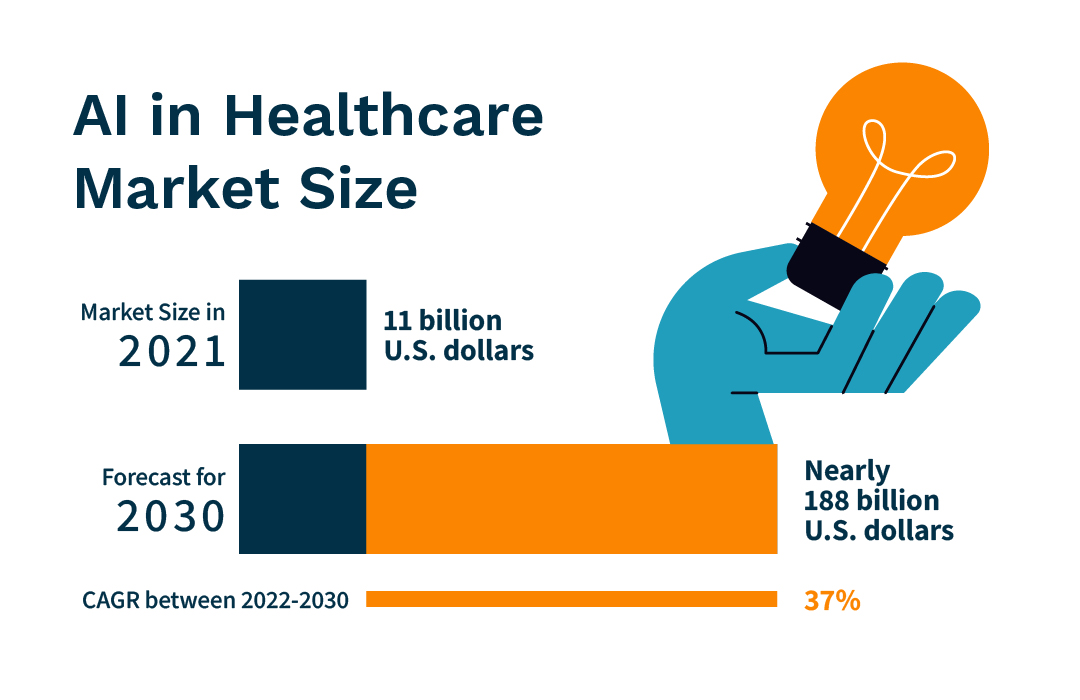

Section 5: The Surge in Healthcare AI & Its Global Impact

Artificial intelligence (AI) in healthcare market size worldwide from 2021 to 2030 (in billion U.S. dollars)

Source: Statista

Key Data Points:

- 2021 market size: 11 billion U.S. dollars

- 2030 forecast: Almost 188 billion U.S. dollars

- CAGR (2022-2030): 37%

The ‘AI in Healthcare’ Revolution: Intellectual Property in a Skyrocketing Market

A Staggering Rate of Growth for AI in Healthcare

The projected market valuation for AI in Healthcare is nothing short of jaw-dropping: from 11 billion U.S. dollars in 2021 to a forecasted 188 billion U.S. dollars by 2030. That’s a Compound Annual Growth Rate (CAGR) of almost 37 percent. For perspective, most industries would celebrate a CAGR in the high single digits; anything above that is considered remarkable. So, a 37 percent CAGR is, in no uncertain terms, astronomical.

An Urgency for IP Managers & IP Professionals To Stay Ahead

This high rate of market expansion translates to a proportionally high rate of innovation. And where there is rapid innovation, there is a commensurately rapid need for IP Protection. Given the pace of the healthcare AI sector, businesses and IP managers can’t afford to adopt a “wait-and-see” approach. Immediate action is necessary to secure competitive advantage and protect market share.

Want to understand how The Intellectual Property Works can help ensure you & your IP Managers are fully equipped with the knowledge, tools and resources needed to stay ahead in the MedTech industry? Book in a free, no obligations call to discuss your situation today

Protecting Intangible Software Assets through Intellectual Property

Healthcare AI, unlike some other medical technologies, is inherently based on software, making its IP landscape particularly intricate. Algorithms, data sets, and even proprietary computational techniques are all part of the core IP assets. Unlike hardware, which can sometimes be reverse-engineered, these software elements can be extraordinarily difficult to patent given their intangible nature and the fast-evolving jurisprudence around software patents.

AI and Data: The Twin Pillars of Intellectual Property in Healthcare AI

As AI in healthcare relies heavily on data analytics, the protection of data sets and the algorithms that interpret them become crucial. In the era of big data, it is no longer just about patenting a singular technology but also about protecting a dynamic ecosystem of interconnected technologies. This translates to a complex, multi-layered IP Strategy that covers not only the AI algorithms but also the proprietary data sets they are trained on.

Exploring Further IP Protection in Trade Secrets and Licenses

Given the difficulties in patenting software, other forms of IP protections, such as trade secrets and licenses, become even more critical. An agile IP strategy for AI in Healthcare may often involve a mix of patents, trade secrets, and licensing agreements, providing a more robust and adaptable protection framework.

Regulatory Compliance as an Additional IP Barrier

AI’s role in healthcare is subject to heavy regulation, and this regulatory scrutiny extends to IP as well. Any AI algorithms employed in diagnostic or treatment scenarios must undergo rigorous validation to ensure they meet medical standards. This creates an added layer of complexity in patenting AI technologies since any patented technology must also be capable of clearing regulatory hurdles.

The Convergence of AI Ethics and Intellectual Property

One emerging area in the AI in healthcare space is the intersection of AI ethics and intellectual property. As AI systems become more autonomous, issues around patient consent and data privacy introduce new challenges for IP strategy. Forward-looking companies are considering these ethical dimensions as they build their IP portfolios.

The Complexity and Imperative of a Robust IP Strategy for AI in Healthcare

The remarkable growth of the healthcare AI market underscores an urgent need for comprehensive and agile intellectual property strategies. With the pace of technological advancement showing no signs of slowing, now is the time for startups, established companies, and IP managers to act. Understanding the nuances of this complex landscape is the first step toward securing a strong and profitable position in this promising sector.

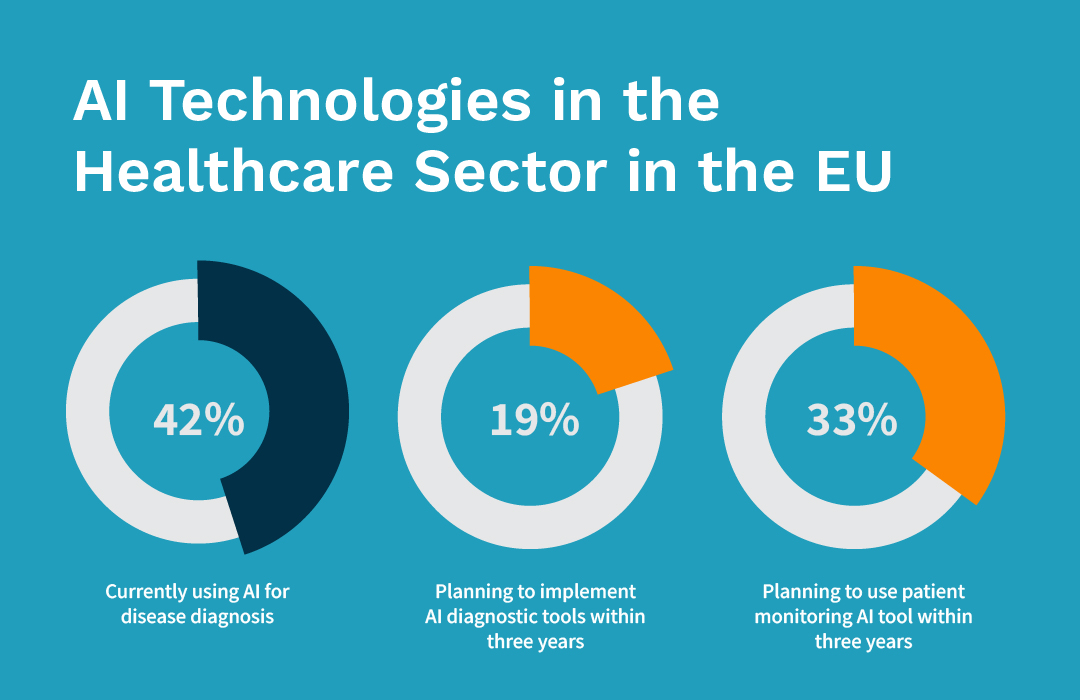

The Road Ahead for MedTech Intellectual Property (IP)

As the data shows, the MedTech industry is experiencing a transformative phase. But what stands out is not just the quantitative leap in growth—it’s also the qualitative shifts in its diverse sectors. From revenue figures that have catapulted from 295 billion euros in 2007 to an expected 633 billion euros by 2024, to nuanced categories within MedTech like in vitro diagnostics (IVD) and cardiology devices, the landscape is as complex as it is expansive.

The spectacular growth trajectory has far-reaching implications for Intellectual Property (IP). Rising revenues mean not just profitability, but also increased capacity for investment in Research & Development. An evolving R&D landscape naturally leads to a growing portfolio of patents, trade secrets, and copyrights, which are integral in maintaining a competitive edge. Therefore, IP isn’t just a legal requirement; it’s a strategic asset that can catalyze innovation and sustainable growth.

For those maneuvering within the world of MedTech, a one-size-fits-all approach to IP simply won’t suffice. Whether it’s the relatively stable but steadily growing In Vitro Diagnostics (IVD) market or the high-potential, high-risk fields like medical robotics and AI in healthcare, an IP Strategy must be multifaceted. By understanding the dynamics of each sector—be it the 3.2% CAGR in IVD or the whopping 37% CAGR in healthcare AI—companies can create a balanced IP portfolio that caters to immediate gains while safeguarding future prospects.

We understand that trying to navigate such a complex & ever-changing market can be a tall order for any company or internal IP Manager. So, if you would like to discuss how we can help you build an effectively structured & expertly managed IP Strategy to secure your business’ present and future interests (and help support your in-house IP Managers) book in a free no obligations call to talk to an expert IP Strategist and former IP Attorney today

Regional Considerations in Intellectual Property Strategy

In this interconnected world, an IP Strategy cannot afford to be parochial. As our analysis revealed, regional variations in the application of AI technologies in healthcare signal the necessity for a nuanced, geo-specific approach to IP Management Factors such as differing healthcare priorities, regulatory frameworks, and emerging markets necessitate a diversified, well-thought-out global IP strategy.

Seize the Moment for Intellectual Property Planning

For startups and established players alike, the present moment is pivotal. The industry is not on the verge of growth; it is in the throes of it. Waiting to develop and implement an IP strategy could mean missing out on capitalizing on the current market trends and could expose companies to risks that could have otherwise been mitigated.

The MedTech industry is not just at a promising crossroad—it’s on a multi-lane highway to a future filled with opportunities and challenges. However, the full potential of this journey can only be harnessed with a well-crafted, agile, and forward-looking IP strategy. So whether you are a nascent startup or a stalwart in the MedTech domain, the clarion call is clear: the time to evaluate, plan, and execute your IP strategy is not in the future—it’s right now.

The Intellectual Property Works has over 25 years of hands-on experience with an extensive background in IP law and IP Protection and utilization. Together, we can ensure your company stays compliant & protects your intellectual property, utilizes current IP assets in the best ways possible, and has an exceptional IP strategy in place that ensures the longevity of your business. Click to book a free, no obligation call with us today